How Vinita Gupta Transformed Lupin Into a Global Leader In Pharmaceutical Industry

Vinita Gupta’s persistence and foresight has made Lupin a force to reckon with in the global generics space

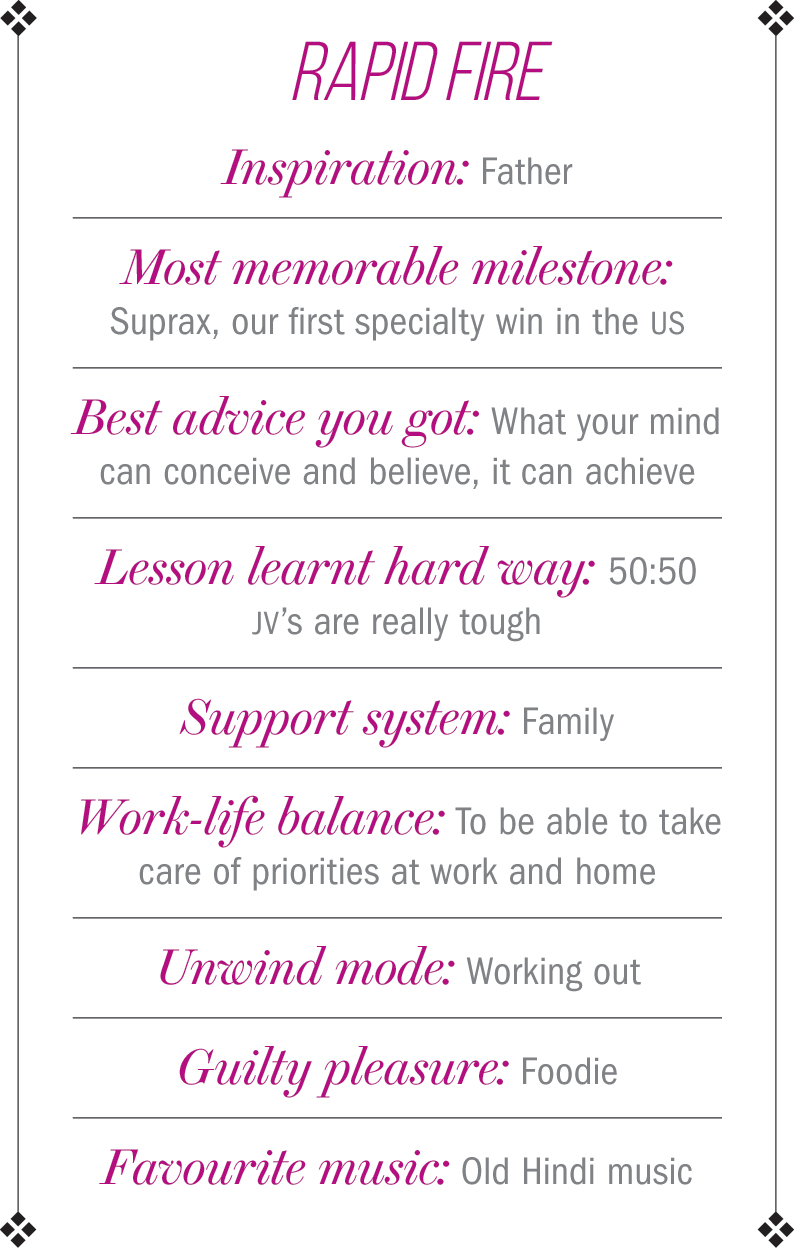

Ever since Vinita Gupta started understanding anything about business, she has had a singular focus– to take homegrown pharma major, Lupin, outside India and to make a material difference through affordable and innovative medicines. “If we did this in the US, we would be ten times the size, given the market potential,” she would often tell her father Desh Bandhu Gupta, who established the company in 1968 to fight then rampant diseases such as asthma, tuberculosis (TB) and diabetes. Over the years, her father, a former professor at the Birla Institute of Technology and Science, Pilani, successfully scaled Lupin to make it the largest maker of anti-TB drugs in the country.

TB, undoubtedly, was a big problem in the country and tackling that cause in such a material manner was a wonderful foundation, acknowledges Vinita Gupta, CEO, Lupin. “But I knew that if we could take the company outside of India, the potential could be multi-fold,” she says. And this was precisely what she focused on when she joined the business as director of business development for Americas — US and Latin America – in 1992.

TB, undoubtedly, was a big problem in the country and tackling that cause in such a material manner was a wonderful foundation, acknowledges Vinita Gupta, CEO, Lupin. “But I knew that if we could take the company outside of India, the potential could be multi-fold,” she says. And this was precisely what she focused on when she joined the business as director of business development for Americas — US and Latin America – in 1992.

A look at the company’s growth since then clearly indicates that her foresight and persistence has paid off. Lupin today is the fourth-largest pharmaceutical player in the US by prescriptions and third-largest Indian pharmaceutical company by global revenues. With a revenue of over Rs.155 billion, and profit of $14 billion, Gupta is confident of making Lupin as a global leader in the pharmaceutical industry.

“Over the last many years my father mentioned multiple times how proud he is. How we have gone above and beyond what he had ever imagined and I would always tell him that I am still in the learning mode,” says Gupta, with a warm smile, as she settles down for a chat with Outlook Business. So what had interested her in the pharmaceutical industry, which has primarily been male-dominated. “DBG would often talk about building the business with so much of passion and purpose that it felt like it was the best thing to be a part of. I used to paint as a kid. When it came to choosing my career, my father thought that it would be great for me to make the best of my skills and go into architecture. But I was clear that I wanted to join the business and make a difference,” she says.

So she joined the Bombay College Of Pharmacy in Kalina, and then briefly worked at Lupin’s site in Aurangabad across divisions such as research & development and manufacturing, before heading to the US to pursue her MBA from JL Kellogg Graduate School of Management, USA, in 1990.

The quest begins

Gupta utilised her time in the US to understand the market potential and ways of entering the market better. For instance, she used her internship with Abbot as an analogy for getting Lupin into developed markets.

By the time Gupta completed her MBA in 1992, her father asked her to develop the blueprint to take Lupin to the US and other countries, and then execute it. “It sounded like a wonderful idea!” remembers Vinita, who joined the company formally in 1992. Her mandate was simple: research where Lupin could make a difference, which products could be launched in the US market and then how they could make their way in.

For the first three years of joining the company, she focused her energies on understanding regulatory requirements, looking at the IP and patent scenario. It was not just about building strategy, but also about building capacity, for which Gupta travelled extensively to countries such as Mexico, Chile, Argentina, and the US. She was also engaged in assessing the capabilities of the team and bringing in experts from the outside to complement them, thereby enhancing their knowledge to participate in new markets.

Based on these visits, Gupta states that the first business plan she put together pegged the opportunity in the US, Europe, and Japan for Cephalosporins at $10 billion. The differentiation, she believed, would come in from the product portfolio and drug pipeline, and their anti-infectives (Cephalosporins) product line (cure for TB) was a good starting point.

Since they did not have a direct presence in the US market, Gupta opted for the joint venture route — where APIs would be brought from India and finished product would be made in the US. But things didn’t go according to plan. “We lost two years in the JV. It was a real challenge. We weren’t making any progress,” recalls Vinita.

She decided to call off the partnership before things went further downhill. “In year 2, we decided to get out of the JV, and got the help of a local counsel to get the capital back from the JV,” she says jubilantly. More importantly, at a fraction of what they had invested in the JV in Puerto Rico, they built their facility in Mandideep in India. It cost them about $5 million and Lupin became the only Asian pharmaceutical company to receive US FDA approvals for its sterile Cephalosporin facility at Mandideep in 2001. They also filed for their first few products including Suprax and Sophixin. “That moment when we got the FDA approval was a golden moment for me. To be the first company out of India to get approved for injectable products truly differentiated us,” says Gupta with a smile.

Stepping Out

By 2001-02, it seemed like the US plan was finally coming together. Cefuroxime Axetil and Suprax were among the first two oral filings with the US FDA, and Lupin was close to signing a deal with Watson Pharmaceuticals in the US for both the products.

However, just before they were about to sign the deal, Wyeth (the company which had been marketing the drug till March 2003) decided to discontinue promotion of Suprax. “We partnered with Watsons only for Cefuroxime Axetil. But I didn’t know what was going to happen to Suprax and neither did Watson. If you don’t have a brand, you don’t have a generic,” she says in a matter-of-fact tone. This could have been a huge setback for Lupin just when things seemed to be going right. But Gupta sniffed a huge opportunity – to launch Lupin as a brand.

The decision surprised many, especially because Indian pharma companies at the time often shied away from getting into the brand side of the business in the US. Vinita, though, says it was a logical move. Plus, by building its branded drugs base in the US, Gupta knew Lupin could leverage this for the European market.

Her father backed her decision, and she quickly put in place a plan. At the time, there were just three people in Lupin’s US office including her but they managed to create virtual infrastructure by developing a partnership with a contract sales organisation and launched Suprax in the market with a campaign that said ‘It’s Back’. In the first year, in 2004, she expected Suprax to generate $30 million in revenue.

But what Gupta hadn’t factored in was the fact that in the 12 months that Suprax was off the market, other Cephalosporins had been launched and garnered market share. “Suprax had virtually no brand recall,” admits Gupta with a laugh. She met a lot of doctors who told her that Lupin had to build a niche for Suprax for it to be successful. Consequently, at the end of the first year, they decided to focus on urinary tract infections (UTI), for which Suprax was one of the best drugs. This hit the nail on the head, and in no time, the prescription and revenue for the drug both went up. The company broke even in the second year in the US and hit profitability in their third year.

Gupta was also instrumental in bringing in private equity investors into the company. Lupin’s non-core diversification into real estate in 1994 cost them heavily and the company was buried under a mountain of debt. In 2002, the company had a debt of Rs.6.30 billion on its books. “The debt was choking us. I was pretty sure that we had to get in a private equity player. The toughest job I had was to convince my dad,” she recalls. Eventually, in 2004, the penny dropped when they found an apt partner in CVC Worldwide, a private equity firm headquartered in London. The firm invested Rs.1.25 billion (about US $27 million) to acquire a 12.55% stake in Lupin helping it reduce its debt burden leading to a valuation re-rating.

Gaining Ground

In 2013, Gupta was made the CEO of the company, a moment she says she would cherish forever. “I remember coming here and papa presenting me a pen. It was signed by him, with a message that starts with ‘on this day as you take the CEO position.’ The talks were on for a while, so it wasn’t a surprise. But the way he did it was beautiful,” she says.

So what changed after that? Nothing, she says, except that there was an added sense of responsibility. “Lupin is a very professional company, but we have a strong family influence on the business. My goal was to take the company to the next level,” she adds.

For this, she and her brother Nilesh Gupta, who looked after the Indian operations, adopted both organic growth and partnerships with firms such as Merck and Fujisawa in Europe and the US respectively, as well as a strategic acquisition policy. In the beginning, it was about geographical expansion such as their first international acquisition — Kyowa Pharmaceutical Industry in 2007. Following acquisitions in Germany, Australia, South Africa, Philippines, Mexico, Russia, and the US were about acquiring expertise in complex generics and specialty products and building brands. In 2015, Lupin made the largest acquisition made by an Indian firm in US when it snapped up New Jersey-based Gavis for $880 million for its expertise in controlled substances and dermatology capabilities to increase its presence in the generics market there. Today revenue from the US accounts for nearly 48% of the overall turnover.

Overwhelming support

During the initial phase of expansion, Gupta states that one of the biggest reasons for her success was her father. “My father would give a tremendous amount of freedom and ownership to all his executives. He was there to support you if things did not go as per plan. And things seldom go as per plan,” she says with a smile. She learned from her father how to transform Lupin into a place where professionals work like family and family works like professionals. He also ingrained in her how it is important to not just make a plan, but to also execute it well.

For instance, while she was working on a plan for the US market, simultaneously, she was thinking of ways to start getting revenues from Latin America and began reaching out to companies in those markets. “I remember I was in the office here, right next to papa, in Kalina. And at the end of the month, he would come into my room asking how much revenue we are getting from Latin America and how much profit are we going to generate from the cephalosporal products. It was wonderful learning early on that you can’t just build a plan and wait for that plan to materialise. You have to take care of the here and now as well.”

Gupta and her brother make the perfect team with her managing the front-end and Nilesh manning the back-end. “Nilesh and I share a wonderful partnership, which started early on. Nilesh was here taking care of research and development, operations, ensuring a strong pipeline and that GMP standard is in place to meet requirements. We worked hand-in-hand to build this success,” says the proud sister.

Besides her father, another strong pillar of support for Gupta is her husband Brij Sharma, a US-based entrepreneur. “My husband supported me 100%. I had my son in March 2005. And by May 2005, I was internalising the brand sales force at Lupin in the US and by end of 2005, we launched the generics business. So, I was back to work within weeks after my son was born. Without his support, I couldn’t have achieved all of this,” she says.

But Gupta is not one to rest on her laurels. She adds that a lot remains to be done. Lupin, she believes, is better poised to leverage future growth opportunities with its strong foundation in generics, heavy investment in complex generics and commitment to building a specialty business. An eternal optimist like her father, Gupta is also determined to retain the culture promoted by him, for that seems to be Lupin’s secret sauce of success.