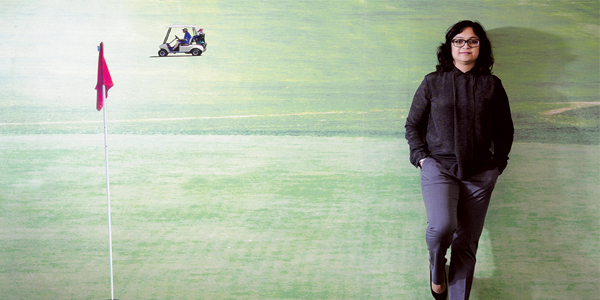

Unhappy turning away women waiting desperately for hours for loans at her bank, she opened her own: Lakhimi Baruah

She has rescued over a hundred underprivileged women from penury and helped them become financially independent, with her microfinance institution, Konoklota Mahila Urban Co-operative Bank

Gita Baruah, who lives in Jorhat, a city in Assam, has changed her fortune. She is financially stable now, and is able to employ at least four others. The 45-year-old makes Rs. 400,000 to Rs. 500,000 annually, which is impressive progress from a state of penury a couple of years ago. “Our financial condition had always been challenging and I always wanted to do something to change that. But I didn’t know how. Luckily, Konoklota Mahila Bank came to my rescue,” Gita tells Outlook Business, taking a small break from her tailoring unit in the heart of Jorhat.

She is one of the hundred others whose lives have been changed after the Konoklota Mahila Urban Co-operative Bank gave them a loan as seed capital or to tide over the loss of the only earning member of a family. The bank, Assam’s first for women and run by women, was the brainchild of Lakhimi Baruah. She founded it, and now heads its operations.

She is one of the hundred others whose lives have been changed after the Konoklota Mahila Urban Co-operative Bank gave them a loan as seed capital or to tide over the loss of the only earning member of a family. The bank, Assam’s first for women and run by women, was the brainchild of Lakhimi Baruah. She founded it, and now heads its operations.

Financial exclusion

Born in 1949 in Golaghat, Assam, Baruah had always seen women struggling to make ends meet in her hometown. After graduating from Jorhat Bahona College, she married in 1973. A few years later, she started working for the District Central Co-Operative Bank and went on to become its Accounts Manager.

During her stint with the bank, she witnessed underprivileged women, most of them illiterate, queue up for a loan for hours. After their patient wait, they would be turned away at the counters because they wouldn’t have the requisite documents with them. It was frustrating for Baruah, who used to sit behind one such counter and hear stories of desperation, of women wanting to escape an abusive marriage or mothers wanting to pay for their children’s education.

So, in 1983, Baruah took a tentative step towards helping them. She established Mahila Samiti, a women’s committee at Dakshin Sarbaibandha in Jorhat, to help women get the financial help they needed from banks and financial institutions.

When she started working here, Baruah gained a deeper understanding of their financial insecurity. Even if the women were making a small income working in tea estates and as domestic help, they had no savings. Their husbands took away their earnings, and the absence of a buffer often landed them in financial distress.

She wanted to open a bank for these women to avail loans and build up savings. “Since my younger days, I have seen that women struggled with their finances, without regular savings. The process and documentation for taking loans from banks scare them. It is harder because most are uneducated. So they end up borrowing from moneylenders at high interest rates,” says Baurah.

She helped women form self-help groups and approach the banks through Mahila Samiti. This too wasn’t very effective because poorly educated women still struggled with paperwork such as address proof and educational certificates. “These experiences made me more determined to start something exclusively for the women, to be run by women. I knew it would not be easy,” she says.

Baruah opened the Konoklata Mahila Co-Operative Bank with 52 promoter members in 1990. “The primary objective of the bank was to provide commercial banking facilities including providing opportunities for self-employment. Another objective was to popularise thrift and banking habit among women,” she says. It may be in pursuit of a noble goal, but registering the bank was impossibly difficult.

They struggled for eight long years. “That period was frustrating. Time and again our proposals were rejected every six months or so. The criteria they set, we couldn’t meet. People, in general, didn’t have confidence in us,” she adds.

They needed to have at least 1,000 members and a capital of Rs.800,000 to begin with. “Despite all our hardships, there was one silver lining, which helped us get where we are today. A few housewives came forward to buy our shares, with their hard-earned money. It was a huge motivation for us. They had chosen to believe in us and our venture,” says Baruah.

The bank was registered on May 22, 1998, under Assam Co-Operative Societies Act, 1949. Finally, in 1999, they could gather Rs.845,000 in capital and the total number of members went up to 1,420.

“This was the 1990s, that too in Assam, It was almost impossible to start something like this. But I was determined. So I personally wrote multiple times to the Reserve Bank of India’s offices in Mumbai and Guwahati, seeking their help in setting up the bank. Thankfully, I received not just their approval but also lengthy replies. Their two letters suggested that I go ahead with opening the bank under the New Licensing Policy for Urban Co-Operative Banks,” says Baruah. Compared to registering the bank, licensing was a cakewalk.

RBI granted a license to the bank on February 16, 2000, for commercial banking. She remembers Day One. “Altogether 17 accounts were opened,” she says. The bank later received additional funding from North Eastern Development Finance Corporation and Small Industries Development Bank of India (SIDBI) and refinance from Rashtriya Mahila Kosh (RMK).

The first branch was opened in 2002 at Gar-Ali. Besides this, they now have three more branches in two districts — Jorhat (Jorhat and Mariani) and Sivasagar (Sivasagar).

Brave leader

The bank started out with six employees, who were selected through a test and on the basis of their qualification. Baruah gives credit to her late husband Prabhat Baruah for being a pillar of strength to all her efforts.

“Even the name was suggested by him. He told us that Kanaklata sacrificed her life for the liberty of the country and we should fight for the financial liberty of women,” she says. Kanaklata or Konoklata Barua is a freedom fighter from Assam who was shot dead during the Quit India movement, while she was carrying the Indian National Flag during a procession, at the age of 17.

At present, the bank manages more than 35,000 accounts in four branches. The deposits total to around Rs.80 million and the share capital, to Rs. 6.5 million.

“We are glad that we have been able to provide loans amounting to Rs.350 million to more than 12,000 beneficiaries. About 300 women self-help groups have taken credit from the bank. Like any other bank, we also have schemes that benefit women. Besides that, we give microloans up to Rs.100,000. Our loans are diversified, covering sectors from agriculture to cottage industries,” Baruah says. According to her, around 70 per cent of the women who are serviced by them are illiterate and more than 80 per cent are from deprived backgrounds. Its membership and lending is for women only, but other banking businesses are open to all.

A first-time applicant is given small-ticket loans of Rs.500, and once they prove their credit-worthiness, they are given larger amounts. For instance, according to Baruah, street vendors who first borrowed Rs.500 from the bank are now eligible for loans of more than Rs.10,000 to Rs.15,000. Similarly, they have daily deposit schemes that accept savings as little as Rs.20 per day. This is to suit the requirements of daily wage labourers.

The Road Ahead

Even at the age of 67, Baruah works constantly and is at the bank every day. “We conduct meetings from time to time and, to spread awareness about Konoklata Bank, we speak about it at social gatherings. This way, we want to reach out to a larger number of women across the state. I dream of having at least one branch in each district of the state before I die,” Baruah says.