Loan ranger

Gowri Thyagarajan Mukherjee jumped at the chance to start a business, a secret wish she always had, and made financing more inclusive

Gowri Thyagarajan Mukherjee, co-founder of CreditMantri, comes from a family of super achievers. Her father ran an automotive-components business, her mother taught maths in Stella Maris College, a leading institution in Chennai, and was instrumental in setting up its computer science lab. Both her parents had a hectic schedule, but managed work and home seamlessly. “I didn’t have to look outside my family for what I had to do. The benchmark set within the household was very high,” she says with a smile.

It was this constant striving for excellence that helped her shape a successful career in banking and financial services spanning nearly two decades and be the force behind one of Chennai’s most successful fintech start-ups.

It was this constant striving for excellence that helped her shape a successful career in banking and financial services spanning nearly two decades and be the force behind one of Chennai’s most successful fintech start-ups.

The Thyagarajan household laid a lot of stress on excelling in academics and Carnatic music. “While I focused on academics, I was also an all-rounder. I used to quiz a lot in school and trek a lot… my first trek was when I was in class two. Those treks made me a lot more independent and confident, from meeting so many different kinds of people,” says Mukherjee who grew up with her grandparents, who held the fort at home when her parents went to work.

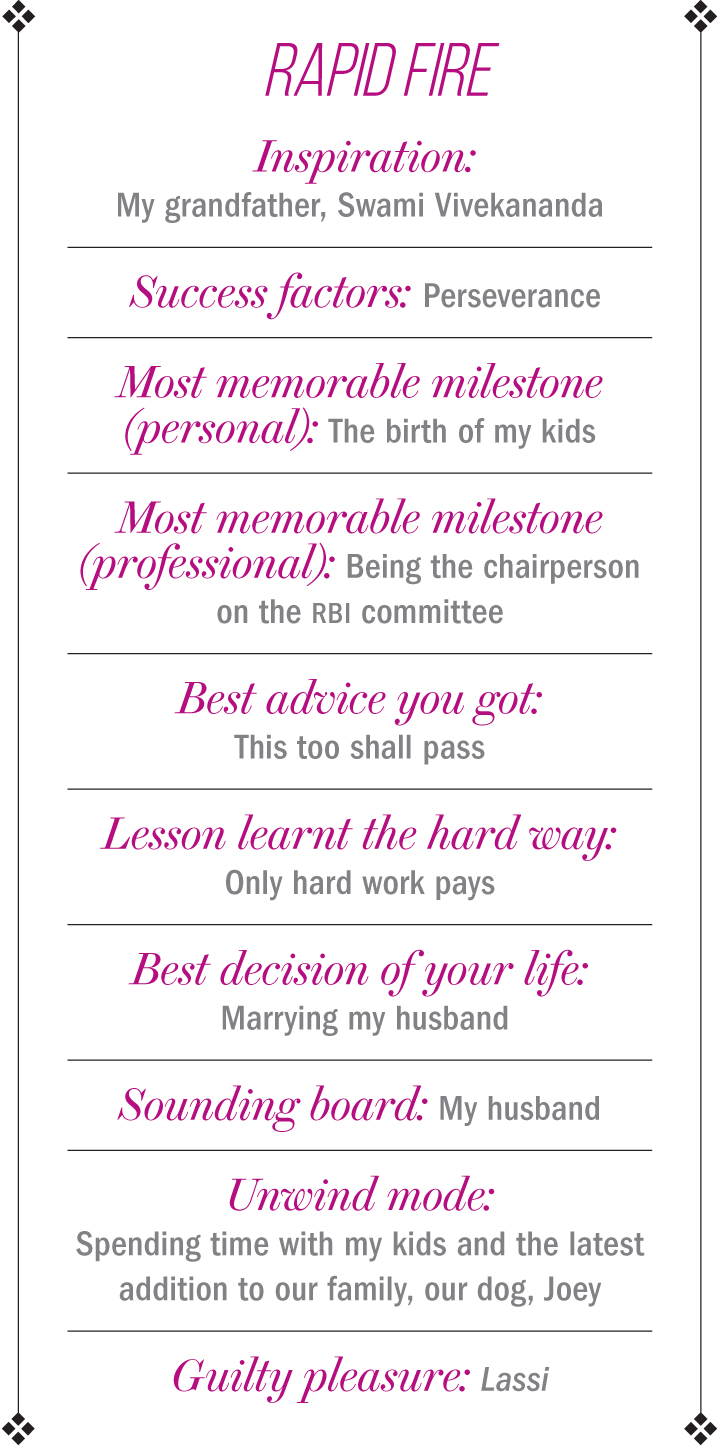

“Growing up, my grandfather was a great intellectual influence and my sounding board. Apart from teaching me how to play chess, he would always encourage me to read a lot and shaped my worldview early on,” she says.

After passing out from Vidya Mandir in 1991, Mukherjee joined BITS Pilani to do instrumentation engineering. Here too she was an outstanding student. In 1995, she went to IIM Calcutta and, according to her, this was a defining period in her life.

One was because she met her husband Surojit there. Secondly, it was here that she tried many things she had never really done before. “I barely attended classes and basically chilled out. But, at the end of two years, I felt bad about it. This wasn’t something that I would normally do. I didn’t like that side of me and that was a turning point, that’s when I decided that I never would do anything to which I don’t give my 100%,” she says with a conviction that is hard to miss.

Despite her taking it easy, Mukherjee managed to land a good job as a manager with HSBC on campus, and she stayed with the British multinational corporation for three years, till 2000. She moved to Sify as a senior consultant after that and, according to her, it was one of her more enjoyable stints. “We were riding the first wave of Internet and I remember we set up the online banking facility for the State Bank of India,” says Mukherjee. It opened her eyes to the possibilities of this connected world, and how it could transform the banking and payments segments.

She moved to Citibank in 2002 and would spend the next decade introducing payment gateways to the likes of Jet Airways and IRCTC, working on the two-factor authentication for the bank’s debit and credit cards, and leading the digital business of Citibank India. But, I enjoyed my stint because I also got the opportunity to be the chairperson on RBI’s committee for additional authentication on debit and credit cards in 2011,” she says with a smile.

In 2012, she moved to Standard Chartered bank as the global head of digital marketing. Since her children were young, she decided to work out of Chennai and travel extensively for work to countries in Asia, Middle East and Africa.

In 2014, she got a call from a former colleague from Citibank, Ranjit Punja. Punja, who along with Rajasundaram Sudarshan, also from Citibank, had co-founded a firm called CreditMantri that would help consumers improve credit scores and become loan-ready. Punja, a Citibank veteran with 23 years of experience, oversaw collections for all consumer lending businesses in over 53 countries. Sudarshan also spent two decades in Citibank overseeing banking operations, technology and outsourcing. Punja and Sudarshan realised that their target group was digitally savvy and that the two of them didn’t have the expertise for it.

So Punja approached Mukherjee with the idea of joining them and building a robust digital platform. “I was excited by the whole idea. I always wanted to do something on my own and it was only a matter of when. Surojit had taken over my father’s business and it was scaling up nicely, so the time was ideal to take the plunge,” says Mukherjee. She even got her husband to meet Punja and Sudarshan to see if they would work well together as team.

Mukherjee finally joined CreditMantri in 2014. While CreditMantri started off by helping people improve their credit rating, they realised that there is a larger market in people with no or little credit history. This second group had no access to regular banking channels. “Using data and technology, we wanted to ensure that a whole host of people who had no prior access to credit were able to avail financial help.”

So the company works with three sets of customers — one with a bad credit history, one with no credit history and one with good credit history. The platform creates credit profiles of customers using data from the Credit Information Bureau (CIBIL), bank statements from financial institutions, data from government and statutory sources, and user-generated data from social media. Then, they help the potential borrowers understand their credit scores and make suggestions on ways they can improve them.

Meanwhile, the start-up’s proprietary algorithm considers the same data points from a client’s profile that a lender would check before making a credit decision. The platform then matches the credit score of the individual to the lending criteria of the financial institutions to ensure the applicants get the best interest rates possible and stand a lesser chance of being rejected. CreditMantri has over a million registered customers and has credit profiled over five million users.

The firm also works with 55 banks and non-banking financial companies to assess credit risk of potential borrowers better apart from bringing down their overall cost of credit assessment. “We are working with a bunch of lenders to offer tailor-made products especially for the new-to-credit segment and the ones with little credit history. It is heartening to see that consumers in both these segments have gained the most by leveraging the credit potential using data from alternate sources (such as social media and other user-generated data),” says Mukherjee. Each algorithm is programmed to suit the needs of the lenders as not all financial institutions trust such data.

With all the founders coming from Citibank, a lot of the key members of the CreditMantri team are from the bank. “We have the same DNA and similar yardsticks to measure performance so there is no second guessing. We have a lot to be grateful to Citibank for shaping our thinking, a questioning mind-set and end-result orientation.” Today, the team at CreditMantri has grown to 150 people. To scale up their operations, the firm has raised about $10.5 million in two rounds from investors such as Elevar Equity, Quona Capital, Chiratae Ventures (previously known as IDG Ventures). Growing at 3x annually, the firm is expected to rake in over Rs.300 million in revenue by the end of FY19. Of course, being an entrepreneur means extra long hours at work. With two kids aged 14 and 11 and both she and her husband having hectic schedules, they rely on their parents and extended family to manage things on the home front. “I don’t think we can do this without their support, and I don’t think about work-life balance as an everyday thing. I just take it as comes. There will be days where work takes precedence and days when things at home can precedence.”

But even as it is the most challenging role that she has taken on, it is one that has made her wiser with a sharper mind. “In a start-up, there is no problem of plenty and you have to manage with the resources on hand. So you put your resources in what you truly believe in the most. The process of making those choices I really enjoy. In a job you have the ability to switch off but when you are entrepreneur you can’t afford to do it. It consumes you,” she says. But there is nothing else she would rather do. “I wouldn’t have traded it for anything else,” she says with a smile.