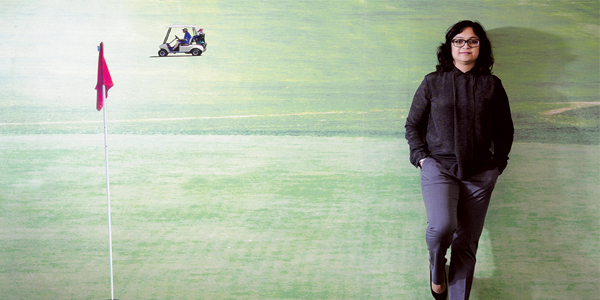

Her persistence and hustle have helped her build a leading mobile-payment company – Meet Mobikwik’s Upasana Taku

Upasana Taku, co-founder, MobiKwik, built the company from scratch and now has 32 million users and 100,000 merchants, doing close to 500,000-1,000,000 transactions every day

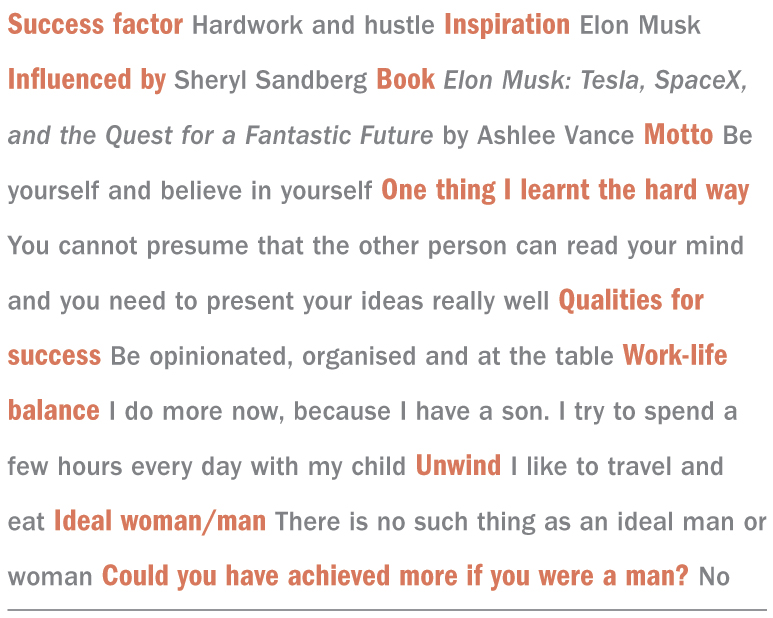

“Don’t you have any male director in your company?” asked an ignorant tax official once to the unassuming female founder of one of India’s leading mobile payments companies. While she had her husband and co-founder Bipin Preet Singh by her side, Upasana Taku asserted to the inquirer that not only did she handle the financial matters of the firm but was also well-qualified to understand the subject. Another time when the co-founders were making a pitch during an investment round, she was asked if she planned to become a mother anytime soon. “I told them it was none of their business and never spoke to the investors again,” she affirms. Despite her Ivy League school credentials, Taku had to put up with gender prejudices when she turned entrepreneur but she didn’t let any of that distract her from her sole ambition. And for this 36-year-old, that was to create a company that simplified the payments acceptance system for retailers in India.

Taku belongs to a Kashmiri family but her professor parents worked in the western state of Gujarat. Born in Gandhinagar, she completed her schooling in Surat, and pursued a degree in engineering from NIT Jalandhar. She then took flight in 2002 to the United States in pursuit of a Masters in Management Sciences from Stanford University. It was there that the seeds of entrepreneurship were sown. “Stanford has an age-old tradition of entrepreneurship. Lots of big companies have been built in its dorms. And it is very industry-oriented as well. Even when you are studying marketing as a part of your theory, you are required to find a company to practice in,” explains Taku. But after graduating from there, like any other middle-class Indian she first secured a job at HSBC Bank. In 2006, she moved on to PayPal as a senior product manager but she was not content with what she was doing. “My interest was to address something fundamental at the grassroot level. Since it would be difficult to do that in the US, I decided to return to India in 2008,” she recounts.

Taku belongs to a Kashmiri family but her professor parents worked in the western state of Gujarat. Born in Gandhinagar, she completed her schooling in Surat, and pursued a degree in engineering from NIT Jalandhar. She then took flight in 2002 to the United States in pursuit of a Masters in Management Sciences from Stanford University. It was there that the seeds of entrepreneurship were sown. “Stanford has an age-old tradition of entrepreneurship. Lots of big companies have been built in its dorms. And it is very industry-oriented as well. Even when you are studying marketing as a part of your theory, you are required to find a company to practice in,” explains Taku. But after graduating from there, like any other middle-class Indian she first secured a job at HSBC Bank. In 2006, she moved on to PayPal as a senior product manager but she was not content with what she was doing. “My interest was to address something fundamental at the grassroot level. Since it would be difficult to do that in the US, I decided to return to India in 2008,” she recounts.

Homeland calling

Eight years ago when she landed in India, it came as a shock for her parents who were working in South Africa then. “I was doing really well and I had a Green Card. So, it didn’t go down well with my parents initially. I ended up not speaking to them for three months,” she recalls. But soon, her academia-oriented parents understood what their daughter was up to and supported her. Taku learnt early on that the easiest way to address something at the grassroot level was to work with an NGO. So in November 2008, she joined a small NGO in Delhi — Drishtee — which operated rural BPOs and was into micro finance. It was here that she got a chance to travel to rural areas in the northern states of Uttar Pradesh and Bihar. “I liked what they were doing but not how they were doing it. NGOs in India are very poorly run,” reveals Taku.

So she moved onto 2020 Social, a start-up that provided social media consultancy services to companies. She hardly worked there for five to six months and quickly realised that it was not her cup of tea. “I didn’t have a professional network in India like in the US. I was doing very well at PayPal and was going to be promoted as a product director in some time. Leaving that and coming back to do something on my own here seemed like a stupid idea to a lot of people,” she shares.

However, things were set to fall in place for the ambitious start-up girl. In December 2008, she met her to-be husband through some common friends. He was working with a Noida-based chip company. His group of friends wanted to start an e-wallet firm, but eventually, it so happened that only Singh and Taku ended up being the last two who were interested in taking the idea ahead. In August 2009, Singh started MobiKwik and Taku joined him five months later. It was only after working with each other that they began dating and eventually got married.

While MobiKwik as an idea sounded great, executing it was quite a challenge. “We faced a lot of resistance from the banks. No bank was ready to give us a platform initially. Our first bank and telco deal was a big achievement for us. From there getting to our first 10,000 customers was even harder,” describes Taku. There were moments of self-doubt early on in the first year when she felt that maybe MobiKwik wouldn’t work out. “The product was up, but the pick-up was not very good. We were boot-strapped. One of our core members left, so morale was low. We set a deadline that if we couldn’t crack a deal in one year’s time, we would start looking for jobs,” she recalls. According to her, it was an uphill task for them to convince the first few partners and their first few employees. “It took us nine months to complete the first deal. The second one happened within the next 20 days. Even hiring the first employee was tough. You needed to convince a person that s/he should work 15 hours a day for peanuts,” confides Taku. Once their first deal came through, there was no looking back.

Despite the hassles, she describes the first four years from 2009 to 2013 as a wonderful time for the company. “We grew to 38 employees without taking any external funding and had broken even. The first round of funding came only by the end of 2013,” she says. While they raised less than $5 million in their first round, MobiKwik has cumulatively secured around $80-85 million in three rounds from Sequoia Capital, Cisco, American Express, Net1 and Tree Line Asia, and the employee count has since reached 190 people.

It was after that when Taku felt like all hell broke loose in the next two years. Easy money found its way into the world of e-commerce and mobile wallets. Competitors like Paytm, which started a year later in 2010, spent a lot of marketing dollars in creating visibility and acquiring customers. But Taku remains unfazed. She believes the era of easy money is now over. “You can create buzz with money for a short period of time. But I am not in the business of creating buzz. You can’t sustain a business by running paid campaigns. Flipkart was everyone’s darling from 2008 to 2014. Then things got tough. Ultimately, it is the business that matters,” she says.

But how does one remain frugal when your competition is throwing crazy money at marketing and cashbacks? “Being frugal doesn’t mean you don’t spend money. You have to spend money for growth, it’s about spending the right amount of money on the right things. For instance, around festivals like Diwali and Holi, people will transact a lot more than usual. You can decide whether you are going to give cashbacks on every transaction or only on 3% of the transactions, but you market it in such a way that everybody thinks that there is a deal that they should avail of,” points out Taku.

Big wallet, more money

India is still a nascent market as far as mobile wallets are concerned, so there is enough headroom to grow. “Only 5% of mobile users or 50-60 million are active users in India. The banks have their models fine-tuned for the branch model of delivery of products and services. So they are not quite ready for digital delivery of services. Now some of the banks after seeing the success of e-wallets are launching their own apps, which is a welcome change. In our model, users are being acquired and served digitally. So if someone wants a loan on a digital platform, he can get it from the app. They don’t have to go to a branch or file 100 papers. This is the way we at MobiKwik are building products,” Taku elucidates. She feels that wallets will acquire digital customers way faster than banks. MobiKwik today has 32 million users and 100,000 merchants, doing close to 500,000-1,000,000 transactions every day. Taku predicts that the number of MobiKwik users will reach 150 million in the next two years. She wants the company to be a one-stop shop for the financial needs of the Indian consumer — be it loans, investments or payments.

Taku isn’t banking on only MobiKwik to achieve her goal of simplifying payments acceptance in India. Once MobiKwik was up and running, she spotted a gap in the payment gateways space. When she launched MobiKwik, she started working with gateways but nothing worked well with her wallet. So Taku decided to start her own gateway and then saw an opportunity to offer the same product to other merchants. That’s when she founded Zaakpay, a digital payment gateway for e-commerce firms in 2010. Zaakpay is operated from the same Gurgaon office as MobiKwik and is a wholly-owned subsidiary of One MobiKwik Systems.

So what does the entrepreneur define as her secret to success? Taku feels that it is her “ability to hustle” and her persistence that have been the drivers of her success. “As you grow your business, you have to continuously hustle, even if you have a 100-member team behind you, and millions of dollars in your bank account. The day you start running your business in a relaxed manner, everything starts going down,” she cautions. Taku values persistence as the most critical trait because no matter how much an entrepreneur hustles there will always be highs and lows in a business. “I think being able to cope with the bad phase is important. For instance, the past 10 months have been very bad for e-commerce companies with many of them struggling to raise money and shutting down. A lot of companies which have shut shop had lot more resources and investors supporting them compared to us. But they still gave up because they found it difficult to deal with reality when the euphoria died down. We didn’t. We kept hustling,” says a triumphant Taku.

While Taku seems to have found the mantra to continue the hustle at work, has she managed to maintain a work-life balance? She explains how that takes on a completely different meaning given that her life partner also happens to be her co-founder. “It is quite difficult. Under normal circumstances, you can always fight with your co-founder and vent it out before your husband at home. But I don’t have that option,” laughs Taku. “We are both opinionated individuals, so sometimes, conflicts follow us home even though we try very hard not to bring them in our personal space. In hindsight, I wouldn’t recommend marrying a co-founder,” she says. Now that she has already gone that route, the couple has taken measures to avoid arguments by separating work responsibilities. Singh oversees the engineering, consumer growth and marketing teams while Taku looks at business partnerships, products and finance. So what’s next on the agenda for Taku and MobiKwik? “We are aiming at a GMV of $1 billion by 2017 and we are expanding our offline presence aggressively. We also hope to be profitable by 2018,” she reveals. Till they reach that goal, life continues to be a daily hustle for the ambitious Taku.