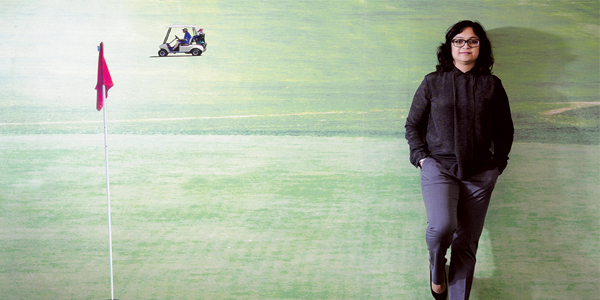

From Ambala’s small town girl to London’s investment banker, Swati Bhargava has lived life upside down before launching CashKaro

Goldman Sachs and Pouring Pounds were stopovers before starting her very own, Indian cashback website

A small-town girl, from a middle-class family living in Ambala, always dreamt of going abroad and making it big in life. Little did she know that one day, she would achieve all that she had wanted. Swati Bhargava, co-founder of CashKaro, fought many odds and started her venture with her life partner six years ago.

“My parents’ zeal to work and meet all our needs has always inspired me,” she says. Her father Ravi Dhawan runs a business in agricultural implements in Ambala and her mother Renu Dhawan opened an NGO Akshdha at the age of 55.

Bhargava lived with her parents till she was in Class X, and then the studious young girl won a scholarship from the government of Singapore and went to live in the city-state. The Singapore Airline Scholarship, given to 35 students from across India, includes the academic fee and living expenses for two years. Bhargava was the only girl in her batch. After her schooling, she bagged another scholarship to the London School of Economics (LSE) from the university itself, where she pursued a BSc (Hons) in Mathematics and Economics. This grant covered 80% of her tuition fee and to fund her living expenses, she worked part-time.

Bhargava says, from living in a small town to studying with students from 171 countries, her world had turned upside and for the better.

She grabbed every opportunity that came her way, and soon became the chairman of a student body with 3,000 members. “At LSE, investment banking hits you from all sides and I was fascinated by it. It was the best way to earn the money that you had invested,” she says.

While Bhargava was at LSE, she did her summer internship in 2005 at Goldman Sachs in London, and was later offered a full-time role as an analyst there. She then took up a position in their credit structuring and sales team three years later, within the investment banking division, which she held for four years. She later moved to the executive office where she managed client engagements and relationships for the co-CEOs of Goldman Sachs International, Richard Gnodde & Michael Sherwood, as an associate.

She gained confidence by working closely with the senior management. “For those five years at Goldman Sachs, I was working round the clock. And I soon realised that, if I had to work so hard, I would rather do it for myself and for something that I own. My body had certainly given up and I needed a break,” Bhargava says. In 2010, she finally called it quits at Goldman Sachs.

“In many of the paths I took, I was the only woman — at Goldman Sachs, I was the only woman in the team along with seven boys. You just need to hold your ground and know what you are doing to make the most of those experiences,” she adds.

Although she was exhausted and needed a break, she was equally ready to start on a new career. In 2009, Bhargava had met and married Rohan. “He had always been very entrepreneurial,” she says. Rohan started his career with an asset management fund, Washington Square, right after completing college in 2004, where he grew the asset base from $50 million to $750 million over five years, moving on to Aladdin Capital, a large US-based hedge fund, where he led the $1 billion acquisition of Solent Capital.

In 2011, the couple launched their first start-up Pouring Pounds, a B2B cashback business. “We had used a cashback site in the UK and were surprised by it. We had not yet used a shopping site that directly transfers funds to your bank account. I told Rohan that we should do something more in the same field,” says Bhargava. The two of them invested their savings in it. The UK-based cashback and voucher website today works with 2,500 popular brands such as Tesco, Debenhams, M&S, Expedia and Argos.

“We thought that this would do remarkably well in India, as people always are always looking for ways to save money in our country. And that is when CashKaro happened, in April 2013,” she says.

Back then, CashKaro had a small one-room office in Gurugram and a team of five people. In the six years of its existence, CashKaro has offered cashback on over 1,500 sites including Amazon.in, Flipkart, Shopclues and Myntra. Today, it has 2.5 million registered users. A customer can save at least Rs 20,000 to Rs 25,000 on an average in a year, the founders claim. “We have given almost Rs 1 billion cashback to our customers in real time till now!” says Bhargava. When a user visiting CashKaro clicks on a tab leading to an e-tailer such as Amazon or Flipkart and shops, the e-commerce site pays CashKaro a commission for driving the sale. CashKaro gives up to 80% of this commission to the user as cashback and keeps the rest.

It seems simple enough, but it has not been easy to get here. Bhargava says there were several meetings with the investors and retailers to build CashKaro. She says, they introduced the concept of cashback in Indian e-commerce and it took a while to educate people about it worked. “In the first three months, we saw a lot of organic growth, though Rohan and I were still in London, but we visited India frequently. I remember how we told our friends in London that the website is doing great and they supported us financially. I did numerous meetings in 48 hours and we closed $750,000 dollars. This was our angel round from UK investors,” she reveals. This made the couple more confident that the business will fare better if they move to India.

CashKaro drew its next investment in 2015, from Kalaari Capital, raising Rs 70 million. “After raising our series A from Kalaari, I spoke to Vani (Kola, the MD and founder of Kalaari Capital) and requested if she could arrange a meeting with Ratan Tata. She did help and we got 15 minutes with him. Towards the end, when I asked him about our business, he said, ‘you’re giving free money to people who love to save, what’s not to love?’” That’s how the duo raised their funding from Ratan Tata the following year.

From leaving London for India and from doing Skype calls with their team to moving base, Rohan and Bhargava have given everything to make their coupon site work. In FY18, CashKaro clocked revenue of Rs 230 million. The cashback site has driven ~Rs 20 billion as GMV, to both larger sites such as Amazon and up-and-coming players such as NNNOW, Ajio, Teabox and Coolwinks. “If you look at countries such as China, they have big cashback companies; I don’t see a reason why we can’t be that for India. I feel that it is the right market to be bullish about,” she concludes.